The financial turmoil surrounding FTX bankruptcy costs has reached staggering heights, accumulating nearly $1 billion in legal fees as more than a dozen law firms strive to navigate the complexities left by Sam Bankman-Fried’s faltering empire. With the court’s approval of $952 million in fees so far, this Chapter 11 bankruptcy stands as one of the most expensive in history, trailing only the notorious cases of Lehman Brothers and Nortel Networks. For the FTX creditors, there is a silver lining; reports suggest that the firm may have around $16.3 billion in assets, allowing for potential reimbursement of funds owed. Despite the chaos, customers are expected to regain 118% of their account balances—an impressive return in the often tumultuous cryptocurrency landscape. As the legal and financial labyrinth continues to unfold, the unfolding saga of FTX underscores the intricate interplay of risk and reward in the world of digital currency investments.

The ongoing struggles of the failed exchange FTX illuminate the staggering financial implications of cryptocurrency bankruptcy as the legal battles intensify. As the case unfolds, the legal fees associated with unraveling this corporate disaster have skyrocketed, placing it in the spotlight for its unprecedented costs. With Sam Bankman-Fried at the center of this tumult, countless stakeholders, including creditors and former customers, are anxiously watching every development. The bankruptcy proceedings, classified under Chapter 11, have triggered a complex web of litigation aimed at recovering lost investments. As FTX navigates through this challenging chapter, the financial health of the broader cryptocurrency market remains under scrutiny.

The Impact of FTX Bankruptcy Costs on Creditor Payments

The FTX bankruptcy case has garnered significant attention due to its staggering legal costs, nearing the $1 billion mark. With such high expenses attributed to managing and resolving the case, many creditors are concerned about whether they will see a return of their funds. Notably, a recent analysis detailed that $948 million has already been allocated to various law firms handling the case, with the total expected to keep increasing as complexities arise in unraveling the web of financial chaos left by FTX’s operations. Given the significant amount owed to creditors, which is projected to reach approximately $11 billion, the hefty legal fees raise questions about how much will actually be recoverable by FTX creditors in the end.

Despite the alarming costs associated with the FTX bankruptcy, there appears to be a silver lining for creditors. Reports suggest that after liquidating assets, FTX may have around $16.3 billion left, indicating a potential for creditors to fully recover their losses—and possibly more. Specifically, FTX customers might see return percentages exceeding their original account balances, which could mean repaying up to 118% of what they invested. While the overarching bankruptcy costs may seem daunting, the expectation of eventual compensation for creditors injects cautious optimism into a situation fraught with uncertainty.

Sam Bankman-Fried and the Fallout of FTX’s Chapter 11 Filing

Sam Bankman-Fried, the former CEO of FTX, has become a central figure in the scrutiny surrounding the exchange’s collapse and subsequent Chapter 11 bankruptcy proceedings. His management style, heavily reliant on basic digital tools such as Google Docs and Slack, not only contributed to an environment of disorganization but also exacerbated the financial reckoning his company faces. Court documents reveal the chaos within FTX, including 80,000 unprocessed transactions piled up in a folder whimsically labeled ‘Ask My Accountant.’ These issues highlight a severe lack of oversight and governance, leading experts to describe the bankruptcy as one characterized by an unprecedented breakdown of corporate controls.

Under the watch of John Ray III, an insolvency expert tasked with the bankruptcy process, revelations about FTX’s operational failures emerged. He pointed out the alarming absence of reliable financial information, suggesting that the struggle to manage an organization with a market value of $32 billion was fundamentally flawed from the start. The fallout from Bankman-Fried’s leadership decisions doesn’t just end with legal ramifications; it also reflects in the financial restitution efforts for aggrieved creditors and customers, showcasing a catastrophic intersection of mismanagement and the emerging cryptocurrency market’s volatility.

Legal Fees and Their Influence on Cryptocurrency Bankruptcy Cases

Legal fees have emerged as a central theme in the ongoing discussion around cryptocurrency bankruptcies, particularly the case of FTX. With nearly $1 billion already incurred in legal costs, it raises substantial queries about the nature and future of financial regulation within the digital currency sector. Traditionally, bankruptcy proceedings come with their own set of inherent costs, but the astronomical legal fees associated with FTX have set a new precedent, making it one of the most expensive Chapter 11 bankruptcies recorded. Lawyers specializing in cryptocurrency law are now being pushed to address the unprecedented legal complexities posed by this case, which may also set a benchmark for future cryptocurrency bankruptcy scenarios.

As the legal teams navigate the turbulent waters of FTX’s operational collapse, stakeholders are becoming increasingly interested in how these legal expenses will influence the overall recovery process. High legal costs could initiate reforms in how cryptocurrency exchanges operate and prepare for potential fiscal disasters, urging them to adopt more rigorous accounting and governance structures. This shift may not only assist in cases like FTX but could also lead to broader improvements in protecting the interests of investors and consumers in the rapidly evolving digital asset landscape.

The Role of Creditors in FTX Bankruptcy Proceedings

Creditors play a pivotal role in the FTX bankruptcy, as their potential recoveries are deeply intertwined with the legal proceedings that are currently unfolding. With approximately $11 billion owed to customers and creditors, their input and claims will significantly shape the direction of the bankruptcy resolution process. As the court endeavors to maximize asset recovery, the stakes for creditors are incredibly high, leading to a vigilant monitoring of proceedings as they await the outcome of this unprecedented case.

In the context of cryptocurrency bankruptcies, FTX represents a unique case, partly due to the intricate relationships between creditors, consumers, and the company itself. Standard bankruptcy laws are still adapting to the nuances of digital currencies, and the treatment of creditor claims in this sector may redefine expectations moving forward. This scenario emphasizes the importance of establishing clearer frameworks for creditor compensation in cryptocurrency markets, ensuring transparency and security as the industry matures.

Examining FTX’s Financial Mismanagement

The financial mismanagement at FTX has been likened to a cautionary tale illustrating the perils of lax corporate governance in the rapidly growing cryptocurrency sector. The organization’s dependence on basic software tools for complex financial operations demonstrates a naiveté that is shocking for a company once valued at $32 billion. Documentation revealing chaotic record-keeping, including ‘Ask My Accountant’ as a folder name for unprocessed transactions, showcases profound oversight failures that contributed to the crisis. These management errors have thus catalyzed the need for more stringent operational controls within the cryptocurrency domain, particularly as the industry faces growing scrutiny from regulators.

In the wake of FTX’s downfall, the lessons learned extend beyond its immediate financial implications. Industry-wide implications are forcing both current and future cryptocurrency exchanges to reevaluate their operational frameworks. Financial integrity and accountability have emerged as crucial tenets in maintaining industry credibility. The fallout surrounding FTX may well establish a precedent for enforcing stricter controls and providing clearer guidelines to safeguard against future mismanagement, ultimately aiming to reinforce investor confidence in the cryptocurrency market.

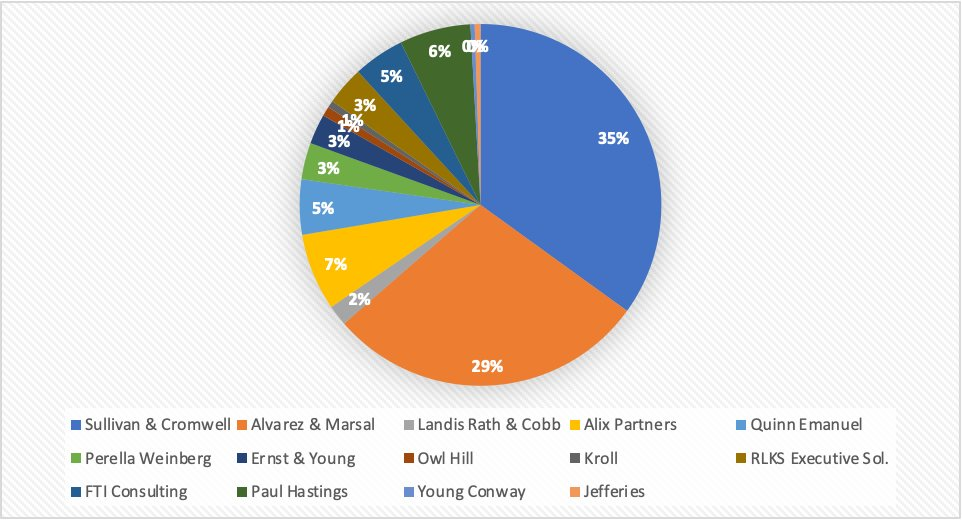

Involvement of Law Firms in FTX Bankruptcy Case

The involvement of law firms in the FTX bankruptcy case has been extensive and costly, with $948 million already allocated to over a dozen firms. The legal teams operate under immense pressure to sift through complex financial records and unravel the opaque dealings that characterized FTX’s operations under Sam Bankman-Fried’s leadership. Given the unprecedented scale of the legal fees, the performance of these firms will be critical in determining how much creditors might eventually recover. The reputation and expertise of these legal professionals are now front and center in this high-stakes scenario, elevating the importance of legal acumen in resolving cryptocurrency disasters.

As these law firms continue their intricate work, their actions will set a benchmark for future legal engagements within the cryptocurrency arena. The cost of managing such bankruptcies may prompt other firms to reevaluate their pricing structures and approaches to complex digital asset cases. Furthermore, the overwhelming fees associated with the FTX bankruptcy underline the necessity for clearer regulations surrounding bankruptcy filings in the cryptocurrency space, potentially shaping future legal precedents as more entities within this industry face similar challenges.

Future Prospects for Cryptocurrency Investors

As the FTX bankruptcy saga unfolds, the reemerging narrative of potential financial recovery offers a glimmer of hope for cryptocurrency investors. Although the legal costs are staggering, the anticipated return of funds for creditors suggests that not all may be lost. The $16.3 billion projected post-liquidation assets indicate that the cryptocurrency market still holds value, even amidst turmoil. The expectation of recovering more than 100% of investments may revive interest and confidence in cryptocurrency ventures among both institutional and retail investors alike.

However, the complexities surrounding the FTX case cannot be overlooked. Investors are becoming increasingly cautious, aware of the risks inherent in the rapidly evolving market despite potential successes in recovery. The FTX bankruptcy highlights the urgent need for improved risk management practices and regulatory measures to ensure that future investors are better protected. Moving forward, lessons learned from this case could play a significant role in redefining investment strategies and regulatory frameworks to foster a more secure cryptocurrency environment.

The Evolution of Chapter 11 Bankruptcy in the Cryptocurrency Sector

The case of FTX marks a significant moment in the evolution of Chapter 11 bankruptcy, particularly for cryptocurrency firms. As traditional bankruptcy systems intersect with the unique challenges posed by digital asset companies, the FTX case is setting an unprecedented precedent for how these businesses navigate insolvency. With near $1 billion in legal fees, the case has forced stakeholders to reconsider existing frameworks and their suitability in accommodating the rapid growth and unpredictability of the cryptocurrency market.

As cryptocurrency adoption continues to rise, the experiences derived from the FTX bankruptcy will likely influence future legislation and legal procedures for managing digital asset insolvencies. The potential for more defined regulations and standards will help streamline bankruptcy proceedings, ultimately protecting investors and ensuring manageable recovery processes for companies facing fiscal emergencies. FTX’s path may serve as a blueprint for the future of how cryptocurrency firms handle financial distress under the existing Chapter 11 framework, facilitating better outcomes for all stakeholders involved.

The Long-Term Implications of FTX’s Collapse on the Crypto Industry

The collapse of FTX holds significant implications for the cryptocurrency industry, beyond just the immediate financial fallout. As one of the largest exchanges in the crypto space, its demise serves as a stark reminder of the vulnerabilities within this decentralized market. The legal battles and uncertainties arising from FTX’s bankruptcy proceedings could result in a more critical examination of operational structures within similar businesses, compelling them to enhance their governance and compliance measures. Investors, regulators, and industry proponents are likely to push for tighter standards and increased transparency moving forward.

Moreover, FTX’s failure could prompt a shift in how cryptocurrency businesses are structured and operated, with an emphasis on risk management and robust financial practices. This might lead to the establishment of industry best practices that could stabilize the market and ultimately rebuild trust among investors. As the dust settles from FTX’s fall, the lessons learned could lay the groundwork for a more secure and accountable cryptocurrency environment, paving the way for sustainable growth and innovation in this burgeoning sector.

Frequently Asked Questions

What are the FTX bankruptcy costs and how have they accumulated?

The FTX bankruptcy costs have rapidly escalated, reaching nearly $1 billion in legal fees as of now. Law firms involved in the bankruptcy case have already been paid approximately $948 million, with an additional $952 million in fees approved by the court. This makes the FTX Chapter 11 bankruptcy one of the most expensive in history.

How do FTX legal fees compare to other bankruptcy cases?

FTX’s legal fees in its bankruptcy case are among the highest ever recorded, second only to Lehman Brothers, which incurred $6 billion in costs during its bankruptcy. Other notable bankruptcy cases, like Nortel Networks, also surpassed $2 billion in costs. Such high legal fees highlight the complexity of the FTX bankruptcy and the challenges associated with unraveling its financial mess.

Who will bear the FTX bankruptcy costs and what does this mean for creditors?

The legal fees associated with the FTX bankruptcy are primarily being covered by the funds available from FTX’s liquidated assets. Creditors, who are owed approximately $11 billion, may benefit as there are predictions of FTX having around $16.3 billion available. This could allow FTX creditors to recover more than their original investments despite the staggering bankruptcy costs.

What challenges are increasing the costs of the FTX bankruptcy proceedings?

The costs of the FTX bankruptcy are increasing primarily due to the chaotic state of FTX’s financial records and corporate governance. Reports reveal that Sam Bankman-Fried’s management relied on insufficient tools such as Google Docs and QuickBooks, leading to a lack of transparency and organization. Legal experts are thus facing extensive challenges in sorting through a mess that includes 80,000 unprocessed transactions, contributing significantly to the rising bankruptcy costs.

How much might creditors expect to recover from the FTX bankruptcy?

Creditors involved in the FTX bankruptcy may expect to recover around 118% of their account balances, thanks to anticipations of approximately $16.3 billion remaining after asset liquidation. This potential for recovery presents a silver lining amidst the ongoing FTX bankruptcy costs, as creditors stand to benefit despite the case’s complexity.

Why is the FTX bankruptcy case considered a complete failure of corporate governance?

The FTX bankruptcy case is labeled a failure of corporate governance due to the poor management practices and lack of reliable financial information, as highlighted by insolvency expert John Ray III. The company relied on inadequate tools for managing a multi-billion dollar cryptocurrency exchange, leading to severe financial disarray. This lack of control has complicated the bankruptcy process, resulting in excessively high legal fees.

Who is responsible for overseeing the FTX bankruptcy proceedings?

John Ray III, a notable insolvency expert, has been appointed to oversee the FTX bankruptcy proceedings. His past experience includes liquidating Enron, and he has voiced concerns about the unprecedented failure of corporate controls observed in the FTX case, making his role crucial in navigating the high costs and complexities of the bankruptcy.

How has Sam Bankman-Fried responded to FTX’s bankruptcy issues?

Sam Bankman-Fried has remained somewhat active on social media, even after the significant legal and financial turmoil caused by FTX’s bankruptcy. His comments about large organization inefficiencies have drawn attention, particularly given the scale of mismanagement in his own company, which has experienced soaring bankruptcy costs.

| Key Point | Details |

|---|---|

| FTX Bankruptcy Costs | Nearly $1 billion in legal fees and rising. |

| Total Legal Fees Paid | $948 million already disbursed to law firms. |

| Court Approved Fees | $952 million in fees approved by the court. |

| Comparison with Other Bankruptcies | Second costliest Chapter 11 bankruptcy after Lehman Brothers ($6 billion). |

| Creditor Recovery Prospects | Expectations to refund 118% of accounts due to anticipated $16.3 billion post-liquidation assets. |

| Management Issues | Company relied on inadequate tools like Google Docs and QuickBooks. |

| Expert’s Comment | John Ray III remarked on complete failures in corporate controls. |

Summary

FTX bankruptcy costs have escalated to nearly $1 billion in legal fees, making it one of the most expensive bankruptcy cases in history. As legal firms work to sort through the chaos left by the collapsed cryptocurrency exchange, the overwhelming costs highlight the poor corporate governance and asset management practices that plagued FTX. Despite these rising costs, there is hope for creditors as FTX anticipates sufficient liquidity to reimburse them more than what they originally lost. This situation underscores the complexities and challenges of bankruptcy in the cryptocurrency sector, raising awareness about the importance of robust corporate controls.