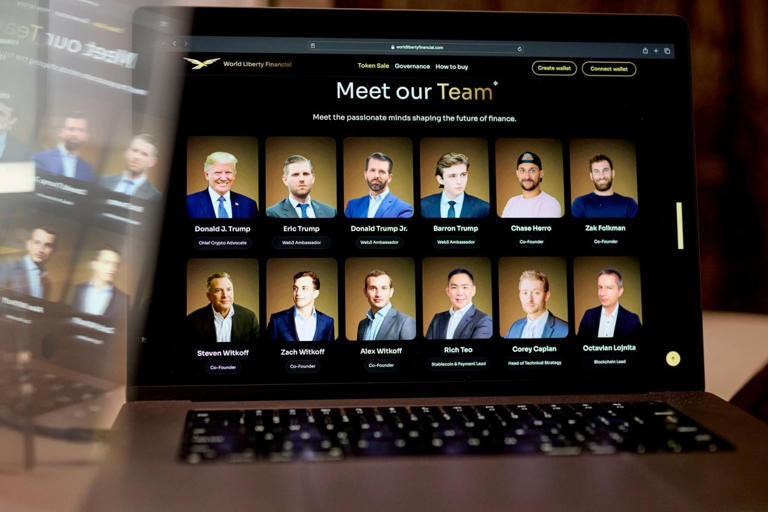

World Liberty Financial stands at the intersection of innovation and influence, emerging as a pivotal player in the realm of decentralized finance. Recently, this cryptocurrency trading platform, primarily managed by the Trump family’s three sons, made headlines by acquiring $25 million in various cryptocurrencies, a move that coincided with the anticipated White House Crypto Summit. With strategic investments in Ethereum and Wrapped Bitcoin, this initiative highlights World Liberty Financial’s commitment to leveraging market trends and capitalizing on the growing crypto market. Furthermore, their recent ‘strategic reserve deal’ with the layer-1 blockchain project SUI has sparked significant interest and discussions around the potential implications for cryptocurrency regulations, especially in light of the Trump administration’s push for governmental efficiency. As the landscape of financial technologies evolves, World Liberty Financial emerges not only as a financial entity but also as a key influencer in shaping future policies and market dynamics.

World Liberty Financial embodies a unique blend of financial strategy and political context, particularly under the auspices of decentralized finance. This emerging platform has attracted attention for its substantial investments in major cryptocurrencies, positioning itself strategically ahead of significant events such as the White House Crypto Summit. The engagement in a ‘strategic reserve deal’ underscores its proactive approach to cryptocurrency market analysis, illuminating the intricate relationship between political influence and the crypto sphere. As the Trump administration continues to redefine governmental operations, World Liberty Financial’s activities may signal a broader, more intricate narrative of financial power interwoven with political ties. Understanding these dynamics is crucial for investors seeking insights into the potential trajectories of cryptocurrency amidst evolving regulatory environments.

The Impact of the Trump Administration on Cryptocurrency Trading

The Trump administration’s approach to governance has had a notable impact on the cryptocurrency trading landscape. Changes implemented under this administration have not only increased transparency in certain aspects but also led to significant market movements. The interest in cryptocurrencies has surged, and many investors are leveraging these new regulations to navigate the crypto market analysis more effectively. As a consequence, we see a heightened engagement from both institutional and private investors who now view cryptocurrency as a viable asset class under the current regime.

Furthermore, the recent activities of significant players in this space, especially World Liberty Financial, underscore the administrations’ influence on cryptocurrency trading. The announcement of substantial investments in cryptocurrencies by powerful entities has sparked renewed interest and speculation among traders. This has led many analysts to study the links between government policy changes and fluctuations in the crypto market carefully, specifically analyzing the surge in value tied to potential regulatory frameworks and strategic reserve deals being discussed.

World Liberty Financial: A Case Study in Decentralized Finance

World Liberty Financial exemplifies the intersection of decentralized finance and high-profile political connections. Managed by members of the Trump family, this protocol has attracted both attention and skepticism regarding its operations. The company’s recent purchase of $25 million in cryptocurrencies, particularly before significant events like the White House Crypto Summit, raises questions about the motivations and legality of such transactions. The interaction between political influence and financial investments poses interesting challenges for regulators in how decentralized finance is perceived and managed.

Moreover, the relationship between World Liberty Financial and prominent figures in decentralized finance exemplifies a growing trend in the industry where connections can significantly impact market strategies. The firm’s engagement in a strategic reserve deal with SUI right before a major market event has fueled speculation about the potential for market manipulation, particularly given the historical volatility of cryptocurrencies. Investigating how strategic moves by firms align with political timelines will be crucial for maintaining integrity in the rapidly evolving DeFi landscape.

Cryptocurrency Market Analysis: Riding the Hype Wave

The cryptocurrency market is notoriously volatile, often reacting sharply to news and events. Recent developments such as the White House Crypto Summit have illustrated how hype can lead to substantial market movements. Investors closely monitor announcements, especially when government officials are involved because they often hint at regulatory frameworks that can significantly affect market stability and growth. In this context, cryptocurrency market analysis becomes crucial as traders seek to exploit opportunities generated by such events.

As the crypto market reacts to government initiatives, the historical precedence set by news such as the ‘Crypto Strategic Reserve’ signals the need for strategic trading approaches. Analysts and investors need to assess not just market trends but also the socio-political environment influencing them. The recent dealings of companies like World Liberty Financial provide a case study on how information dynamics can shape trading strategies and underscore the importance of real-time analysis as part of broader market engagement.

Strategic Reserve Deals and Their Influence on Crypto Values

Strategic reserve deals, like the one World Liberty Financial entered with a layer-1 blockchain project, significantly influence cryptocurrency values. These deals can create excitement in the market, leading to increased investment activity and speculation. When influential companies engage in such transactions, the subsequent price spikes highlight the sensitivity of the crypto market to perceived value changes. Crypto investors must remain vigilant and consider such strategic maneuvers when constructing their portfolios.

The proactive steps taken by companies like World Liberty Financial not only reflect their confidence in the future of cryptocurrency but also affect broader market perceptions. The increase in the value of SUI following their strategic reserve deal exemplifies how policy reactivity and market speculation intertwine. Understanding the implications of these strategic approaches is essential for anyone involved in the rapidly evolving crypto space.

The Connection Between Political Figures and Cryptocurrency Success

The intricate relationship between political figures and the success of cryptocurrency ventures has become increasingly evident. The Trump administration’s links to firms like World Liberty Financial raise significant questions about the nature of these connections and their impact on market dynamics. Investors often look for affiliations that can confer advantages, and a connection to high-profile political figures can lend credibility and attract investments, thereby adding to the volatility of the crypto market.

However, this situation also opens up a dialogue on the ethical implications of such relationships. With insights into the workings of World Liberty Financial showing that the Trump family can claim 75% of the net revenue, concerns arise regarding favoritism, and the potential for policy shaping in favor of personal gain rather than public interest. As cryptocurrency continues to grow in popularity, understanding the interplay between political connections and market success will be critical for stakeholders looking to navigate this space.

Navigating the Crypto Market: Learning from World Liberty Financial

In the volatile environment of the cryptocurrency market, learning from successful models like World Liberty Financial can provide crucial insights for investors. The rapid actions taken by this firm, particularly in relation to significant announcements and regulatory developments, showcase how timely decisions can drastically affect investment outcomes. By examining their strategies, investors can glean invaluable lessons on market timing and the importance of being adaptive amidst changing landscapes.

Additionally, the recent scrutiny on the financial dealings of companies tied to influential political figures suggests that investors should enhance their due diligence processes. Learning from World Liberty Financial’s approaches, especially regarding their engagement with decentralized finance and strategic reserve deals, can significantly empower traders to make more informed decisions. As the crypto market continues to evolve, incorporating strategic learning from key players will be pivotal to achieving success.

The Future of Decentralized Finance Post-Trump Era

As the political landscape shifts when the Trump administration transitions, the future of decentralized finance (DeFi) could see substantial changes. The policies and initiatives introduced during this period have laid groundwork for how DeFi platforms operate and interact with regulatory bodies. Investors in cryptocurrencies must prepare for a post-Trump era where established frameworks may change, impacting everything from compliance standards to market accessibility.

Moreover, pioneering companies like World Liberty Financial will need to adapt to the evolving regulatory climate. As global interest in DeFi continues to rise, how firms navigate these changes will determine their longevity and market presence. Keeping an eye on legislative developments and how they correlate with cryptocurrency trading becomes imperative for investors intent on remaining competitive in the face of uncertainty.

Speculative Trends in the Cryptocurrency Market

Speculation plays a crucial role in shaping trends within the cryptocurrency market. As events unfold, like World Liberty Financial’s large-scale crypto purchases, investors often react based on perceived potential rather than purely on fundamentals. Such speculative trends lead to price surges but can also create risk as the market becomes dependent on hype rather than sustainable growth.

Traders must remain critical of these speculative trends, adopting a balanced approach that factors in both market hype and underlying value. Understanding the nuances of speculative behavior can yield advantages in decision-making, especially when navigating the highly reactive environment of cryptocurrency trading. The interplay between speculation and tangible growth is a pivotal topic for analysis moving forward.

The Role of Market Analysis in Strategic Crypto Investment

Market analysis serves as a compass for strategic investments in the cryptocurrency sector, especially amidst the increasing involvement of political figures. Institutions and investors alike should prioritize comprehensive analysis to capitalize on trends, such as those initiated by World Liberty Financial. Engaging with various analytical frameworks can lead to more informed decisions, ultimately shielding investors from uncalibrated risks associated with the cryptocurrency market.

Moreover, a robust market analysis enables investors to differentiate between hype-driven surges and lasting value propositions. As the cryptocurrency landscape continues to evolve, relying on in-depth materials and resources for economic evaluation becomes essential. Adopting a proactive stance on market analysis will empower investors to navigate complexities and make informed investment choices.

Frequently Asked Questions

What is World Liberty Financial and how does it relate to cryptocurrency trading?

World Liberty Financial is a decentralized finance protocol significantly involved in the cryptocurrency trading sector. Managed by the Trump family’s financial offshoot, the platform engages in trading various cryptocurrencies, including major assets like Ethereum and Wrapped Bitcoin (WBTC). With their recent investments, including a $25 million purchase, World Liberty Financial exemplifies the evolving dynamics of crypto market trading influenced by high-profile affiliations.

How did the Trump administration influence World Liberty Financial’s strategies in decentralized finance?

The Trump administration’s deregulatory policies have indirectly influenced World Liberty Financial by creating an environment ripe for decentralized finance (DeFi) growth. The administration’s emphasis on innovation aligns with the firm’s operations, which thrive in the less regulated DeFi landscape, allowing strategic financial moves, such as their recent strategic reserve deal with SUI that has boosted investor interest.

What impact does World Liberty Financial have on the crypto market analysis?

World Liberty Financial plays a crucial role in crypto market analysis due to its substantial transactions and the intrigue surrounding its affiliations with prominent figures. As a decentralized finance platform that recently invested heavily in cryptocurrencies right before significant events like the White House Crypto Summit, analysts often scrutinize its decisions for insights into market movements and potential price surges related to political developments.

What is the significance of the strategic reserve deal announced by World Liberty Financial?

The strategic reserve deal announced by World Liberty Financial holds significant importance as it reflects the company’s commitment to integrating with leading blockchain projects, such as SUI. Such collaborations typically lead to increased market activity and can positively affect the price dynamics of associated cryptocurrencies, thereby influencing broader market trends, particularly in the aftermath of high-profile events.

How does World Liberty Financial’s operations reflect hype in the cryptocurrency market?

World Liberty Financial’s operations illustrate the hype-driven nature of the cryptocurrency market, especially following notable announcements. For instance, their significant investments and strategic deals preceding the White House Crypto Summit suggest that the crypto market often reacts strongly to news surrounding influential individuals and initiatives, causing immediate price movements and increased trading volume.

Why have investors shown interest in World Liberty Financial’s cryptocurrency tokens?

Investors are drawn to World Liberty Financial’s cryptocurrency tokens due to their association with the Trump family and the potential for political influence in the crypto sector. Many perceive that connections to high-profile figures can lead to favorable market conditions, making investments in these tokens appealing as they hope to capitalize on the momentum generated by political events and strategic business decisions.

What are the risks associated with investing in World Liberty Financial?

Investing in World Liberty Financial carries inherent risks, primarily due to its association with high-profile political figures and the volatile nature of the cryptocurrency market. The potential for regulatory changes or market manipulations highlights the need for cautious analysis before investing, as recent events have shown how quickly market dynamics can shift following political developments.

| Key Points | Details |

|---|---|

| Trump Administration’s Efficiency | The administration has reduced inefficiencies, making favoritism and self-dealing more visible. |

| World Liberty Financial’s Cryptocurrency Purchase | Purchased $25 million in cryptocurrencies before the White House Crypto Summit. |

| Strategic Reserve Deal | Entered a deal with SUI blockchain, increasing the coin’s value. |

| Market Responsiveness | The cryptocurrency market reacts strongly to hype, as shown by prior successes. |

| Connection to Trump Family | World Liberty Financial is managed by Trump’s sons, raising ethics concerns. |

| SEC Investigation | Justin Sun faced allegations of fraud related to his connection with World Liberty Financial. |

| Investor Appeal | Investors are attracted to World Liberty Financial due to its connection to Trump. |

| Revenue Structure | The Trump family can claim 75% of World Liberty Financial’s net revenue. |

Summary

World Liberty Financial exemplifies the intertwining of governance and private interests, especially in the cryptocurrency landscape. This organization, connected closely to the Trump family, demonstrates how strategic initiatives can leverage political events to benefit financially. As the cryptocurrency market remains sensitive to external catalysts, movements made by World Liberty Financial and its leaders, particularly during events like the White House Crypto Summit, may raise essential questions regarding ethics and investment strategies. Investors should stay informed about the implications of these connections while exploring the innovative potential of decentralized finance.